Simplify Payroll Management-- Contact CFO Account & Services for Payroll Services Currently

Simplify Payroll Management-- Contact CFO Account & Services for Payroll Services Currently

Blog Article

Navigating the Intricacies of Pay-roll Service: A Total Guide for Business Owners

As entrepreneurs endeavor into the world of handling their businesses, the complexities of pay-roll services often present a maze of difficulties to navigate. From analyzing payroll taxes to guaranteeing conformity with wage legislations, the journey can be overwhelming without a comprehensive overview.

Comprehending Payroll Tax Obligations

Employers need to precisely calculate and keep the appropriate quantity of tax obligations from employees' paychecks based upon variables such as revenue degree, filing standing, and any kind of allowances asserted on Form W-4. Furthermore, businesses are in charge of matching and remitting the suitable part of Social Safety and Medicare taxes for each and every staff member.

Comprehending pay-roll taxes entails remaining current with tax obligation laws and laws, which can be complex and subject to transform. Failure to abide by payroll tax obligation requirements can cause expensive charges and penalties for companies. Therefore, services must guarantee they have the knowledge and procedures in position to handle pay-roll tax obligations accurately and effectively.

Choosing the Right Payroll System

Browsing payroll solutions for business owners, particularly in understanding and handling payroll taxes, underscores the critical significance of selecting the ideal payroll system for reliable financial operations. Selecting the proper pay-roll system is essential for companies to improve their payroll procedures, guarantee conformity with tax obligation laws, and keep accurate financial records. Business owners have numerous choices when it involves choosing a payroll system, ranging from hand-operated approaches to sophisticated software solutions.

When selecting a payroll system, business owners must consider variables such as the dimension of their company, the complexity of their payroll needs, budget plan constraints, and the level of automation wanted. Local business with simple payroll demands might select fundamental payroll software program or outsourced pay-roll services to handle their payroll tasks successfully. On the other hand, bigger business with more intricate payroll structures might benefit from innovative payroll systems that use functions like automatic tax estimations, direct deposit capacities, and assimilation with bookkeeping systems.

Eventually, the trick is to choose a payroll system that straightens with the organization's details demands, improves operational efficiency, and makes sure timely and precise payroll processing. By selecting the right pay-roll system, business owners can efficiently handle their pay-roll duties and concentrate on expanding their companies.

Conformity With Wage Laws

Making sure compliance with wage regulations is a basic element of keeping lawful stability and honest requirements in organization operations. Wage regulations are made to protect staff members' rights and guarantee reasonable payment for their job. As a business owner, it is important to remain notified concerning the particular wage legislations that relate to your organization to stay clear of prospective financial charges and lawful problems.

Trick factors to consider for conformity with wage legislations consist of adhering to minimum wage requirements, accurately classifying staff members as either excluded or non-exempt from overtime pay, and guaranteeing prompt settlement of earnings. It is additionally vital to keep up to day with any kind of modifications in wage regulations at the government, state, and local degrees that might influence your business.

To effectively browse the complexities of wage legislations, take into consideration executing payroll software program that can help guarantee and automate computations accuracy in wage payments. Additionally, looking for guidance from lawyers or HR experts can give important insights and assistance in preserving compliance with wage laws. Contact CFO Account & Services for payroll services. By prioritizing compliance with wage regulations, business owners can produce a foundation of trust and justness within their organizations

Improving Pay-roll Processes

Efficiency in managing payroll processes is extremely important for image source entrepreneurs looking for to enhance their organization operations and ensure timely and precise compensation for employees. Streamlining pay-roll processes includes applying techniques to streamline and automate jobs, inevitably conserving time and reducing the threat of mistakes. One effective method to streamline pay-roll is by purchasing payroll software that can systematize all payroll-related data, automate estimations, and produce reports seamlessly. By leveraging technology, business owners can remove manual information entry, improve data accuracy, and make certain compliance with tax regulations.

Furthermore, outsourcing pay-roll services to a reputable copyright can additionally enhance the procedure by offloading tasks to experts who specialize in payroll administration, allowing business owners to concentrate on core service activities. By improving payroll procedures, entrepreneurs can boost effectiveness, precision, and conformity in taking care of employee compensation. Contact CFO Account & Services for payroll services.

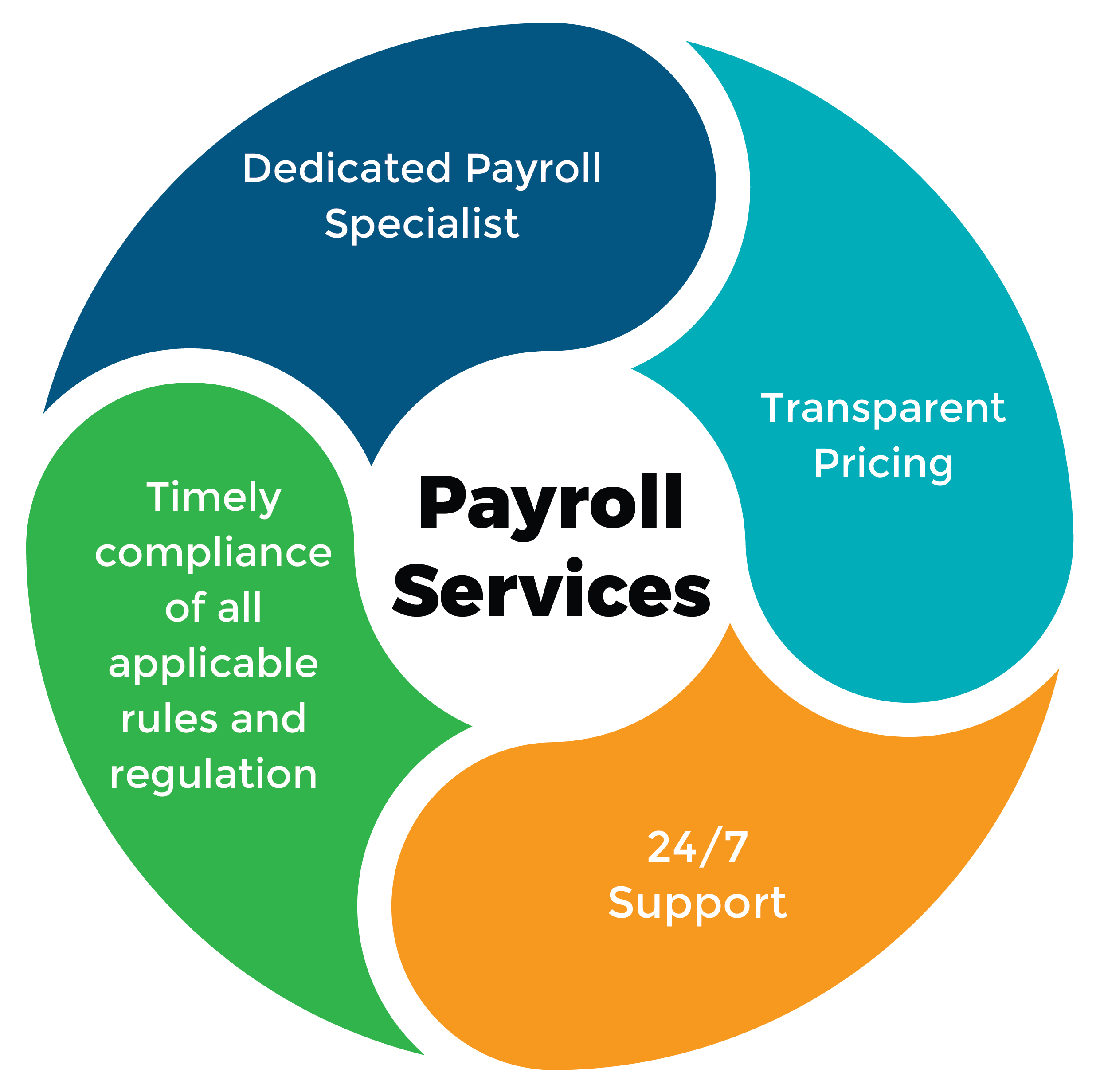

Outsourcing Payroll Services

Thinking about the complexity and lengthy nature of pay-roll monitoring, several entrepreneurs opt to why not check here outsource payroll services to specialized suppliers. Contracting out payroll services can provide numerous advantages to organizations, consisting of price financial savings, increased accuracy, compliance with tax obligation policies, and liberating beneficial time for business owners to concentrate on core company activities. By partnering with a reliable pay-roll provider, entrepreneurs can make sure that their workers are paid accurately and on schedule, tax obligations are calculated and submitted properly, and pay-roll data is securely handled.

Conclusion

In conclusion, navigating the complexities of pay-roll solution requires an extensive understanding of payroll taxes, picking the proper system, adhering to wage legislations, maximizing procedures, and possibly outsourcing services. Business owners have to meticulously take care of pay-roll to make sure compliance and performance in their service procedures. By complying with these standards, business owners can successfully handle their payroll responsibilities and concentrate on growing their company.

Report this page